Protection Packages With Deductible Reimbursement

Now Available To All Texans

With the cost of everything continually going up, we show you how you can get reimbursed a portion of and in many cases your entire deductible, when you file a claim on your home or vehicle policy.

Explore Products

What does the home deductible coverage include?

Our plan will reimburse you up to $2,500 for your home insurance deductible (limited to one reimbursement per year). This helps lower your net out-of-pocket cost when you have a covered loss at home.

What else does it include?

Glass Breakage Benefit: Reimbursement up to $200 (twice per year) to assist with the cost of replacing broken windows, ensuring quick and stress-free repairs.

Lockout Service: If you find yourself locked out, we reimburse up to $100 (twice per year) for a licensed locksmith to help you regain entry into your home, available twice per year.

Appliance and Electronics Repair: We reimburse you for 50% of the repair costs for damaged appliances and electronics in your home, up to $500 per repair and a maximum of $1,000 annually.

Emergency Lodging: If your home becomes uninhabitable due to a covered disaster like a fire or flood, we can reimburse you up to $1,000 ($100 per night for 10 nights) for temporary lodging, providing a safe place for you and your family while repairs are made.

*Refer to terms and conditions for full plan details.

How much does it cost?

The Home Protection Plan is available for an annual fee of $189.

How can I purchase this plan?

We make it super simple. You can buy this plan directly through our website or calling us at (888) 274-2194.

What does the vehicle protection plan include?

Our plan reimburses up to $1,000 per loss for any deductible you pay when you file a claim with your vehicle insurance, and there’s no limit on the number of claims you can make each year.

Plus:

Coverage for Different Incidents: Applies to both collision and comprehensive claims, providing financial support for damages or losses related to accidents, theft, natural disasters, and other covered incidents.

Unlimited Deductible Reimbursements: Reimburses the deductible you pay up to $1,000 per incident, with no limit on the number of times you can claim this benefit each year.

Repair Reimbursement: After a 30-day waiting period, you can receive a 20% reimbursement for non-routine vehicle repairs, up to $500 per repair, with a maximum of $1,000 reimbursement per year.

Emergency Travel Benefits: If your vehicle breaks down and cannot be driven, and you're far from home, the plan covers up to $100 per night for lodging and $100 per day for meals for up to five days.

*Refer to terms and conditions for plan full benefits

What types of vehicles are covered?

The plan covers a wide range of personal vehicles including cars, motorcycles, boats, all-terrain vehicles (ATVs), recreational vehicles (RVs), golf carts, and personal watercraft.

How much does it cost?

The Vehicle Protection Plan is available for an annual fee of $189.

How can I purchase this plan?

We make it super simple. You can buy this plan directly through our website or calling us at (888) 274-2194.

Total Assurance for Texans: Protecting Your Home, Vehicles, and More

At Texas Assurance, we understand the value of peace of mind. That's why we offer comprehensive protection plans designed specifically for Texas residents, reimbursing everything from vehicle deductibles to home repairs and beyond. Whether you're looking to safeguard your car, boat, or residence, our plans ensure you're covered against the unexpected.

Plus, with additional perks like ID theft restoration and warranty management, Texas Assurance provides an all-in-one solution to keep you, your family, and your possessions secure. Join the millions of satisfied customers who trust us to enhance their security and minimize their financial risks.

Home Protection Plan

Our Home Protection Plan makes sure your home is always safe and sound. If something bad happens to your home, like a broken window or a locked door, this plan can help reimburse you for the costs.

It will reimburse you up to $2500 for your home insurance deductible once a year and also reimburses you for repairs to appliances and electronics in your home.

This plan is a great way to keep your home in top shape without worrying about big unexpected bills.

Save Up To $2,500 On Your Home Deductible & More

A Single $189 Payment Protects You For 12 Months

All-Vehicle Protection Plan

The All-Vehicle Protection Plan is here to help you save money on your vehicle costs.

If you have to pay a deductible after an accident or for a repair, this plan will reimburse you up to $1000 for each claim, and you can make as many claims as you need throughout the year.

It covers all types of personal vehicles like cars, motorcycles, and even boats. Plus, if your vehicle breaks down, you can get help with repair costs and travel expenses.

Save Up To $1000 On Your Vehicle Deductible & More

A Single $189 Payment Protects You For 12 Months

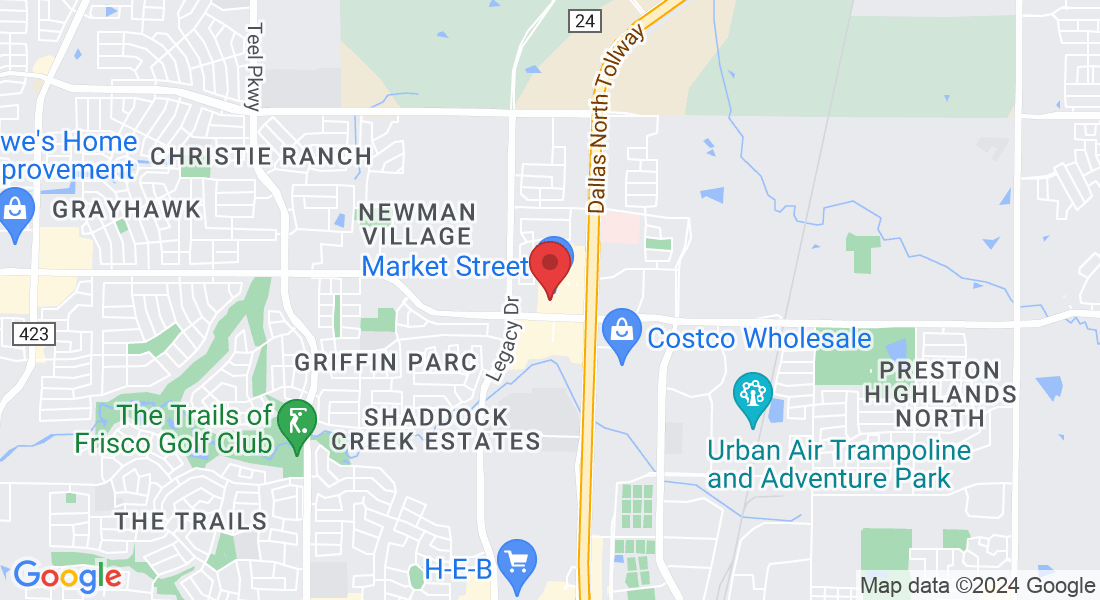

Dedicated to Delivering Peace of Mind and Security to Home and Vehicle Owners

About us

At Texas Assurance, we specialize in providing top-notch protection plans for our customers.

Our focus is on delivering reliable and comprehensive coverage for your home and vehicles, ensuring you're prepared for the unexpected.

With millions of satisfied customers already enjoying the benefits of our plans, we're dedicated to offering peace of mind through exceptional service and support.

Join the community that trusts Texas Assurance to keep their investments safe and sound.

TEXAS ASSURANCE BENEFITS

Home Protection Plan

Deductible Protection: Reimburses up to $2500 for your home insurance deductible once per year.

Repair Assistance: Offers partial reimbursement for repairs to appliances and electronics in your home.

Additional Services: Includes coverage for glass breakage and locksmith services for home lockouts.

Drive With Confidence: Our All-Vehicle Protection Plan

Deductible Reimbursement: Reimburses up to $1000 back for each vehicle-related claim, with no limit on the number of claims per year.

Comprehensive Coverage: Includes cars, motorcycles, boats, and other personal vehicles under personal use.

Additional Support: Provides reimbursement for emergency travel and repair expenses.

Additional Package Benefits

ID Theft Restoration: Professional help to restore your identity if you become a victim of identity theft, ensuring your personal information is secured.

Warranty Vault: Convenient online service to store, manage, and access all your warranty information for consumer products, making it easy to utilize your warranties when needed.

Emergency Lodging Reimbursement: Up to $1,000 per claim to cover lodging if your primary residence is uninhabitable due to disasters like fire or flood.

Extended Emergency Lodging for Climate Control Failures: Additional reimbursement coverage up to $1,200 for lodging if essential home systems like air conditioning or heating fail during critical times.

Testimonials

Samantha P.

"Texas Assurance reimbursed me $2500 on my roof deductible after a severe hailstorm—couldn't be more grateful!"

Mike R.

"I’ve never felt more secure than I do with my coverage from Texas Assurance; it’s comprehensive and affordable."

Jolie S.

"When my roof was damaged during a storm, Texas Assurance reimbursed the entire $2500 deductible, making repairs possible without financial stress."

*This summary is a brief overview of the program and is not to be considered a full disclosure of policy terms. Please refer to the Terms and Conditions for completeforms, conditions, limitations, definitions, and exclusions.

FAQS

What types of protection does Texas Assurance offer?

We specialize in All-Vehicle and Home Protection Plans, providing reimbursement coverage for vehicle deductibles, home deductibles, and various repairs and emergencies specific to residents of Texas.

How much can I get reimbursed for my home deductible?

Our Home Protection Plan offers up to $2500 reimbursement per claim (one time per year) for your home deductible, ensuring significant savings on major repairs.

Are there any limitations on the number of claims I can make for vehicle deductible reimbursements?

No, our All-Vehicle Protection Plan allows an unlimited number of claims, each reimbursing up to $1000 per loss.

What does the Home Protection Plan cover besides deductible reimbursement?

It includes reimbursement for glass breakage, locksmith services if you're locked out, and partial coverage for appliance and electronic repairs.

How soon after enrollment do my benefits begin?

Most benefits are active from day one of your coverage, except for specific repair reimbursements which begin 30 days after enrollment.

Can I use the plan for repairs to any vehicle?

The protection package includes personal, non-commercial vehicles including cars, motorcycles, boats, and recreational vehicles, as specified in our policy details.

How do I file a claim if I need to use my insurance?

You can file a claim through our online portal or contact our customer service directly for assistance in submitting your claim documentation.

Where can I find the full terms and conditions for Texas Assurance LLC's insurance plans?

The full terms and conditions are available on our website, and you can also contact customer service to request a copy.

*This summary is a brief overview of the program and is not to be considered a full disclosure of policy terms. Please refer to the Terms and Conditions for complete forms, conditions, limitations, definitions, and exclusions.